In the ever-evolving world of cryptocurrency, meme coins have carved out a unique niche, blending internet culture with digital finance. While tokens like Shiba Inu (SHIB)...

Bitcoin has reached a new all-time high, surpassing $122,000, driven by strong institutional demand and favorable macroeconomic factors. Stock market information for Bitcoin (BTC) Bitcoin is...

Staking: An Overview Staking has become a popular method for cryptocurrency holders to earn passive income by participating in network operations. Traditionally, platforms like Polkadot and...

In the ever-evolving world of cryptocurrency, the balance between user privacy and regulatory compliance remains a hot topic. As of July 2025, the landscape for no-KYC...

Galaxy Digital and Fireblocks Join Forces to Enhance Institutional Crypto Staking In a significant development for the cryptocurrency industry, Galaxy Digital has partnered with Fireblocks to...

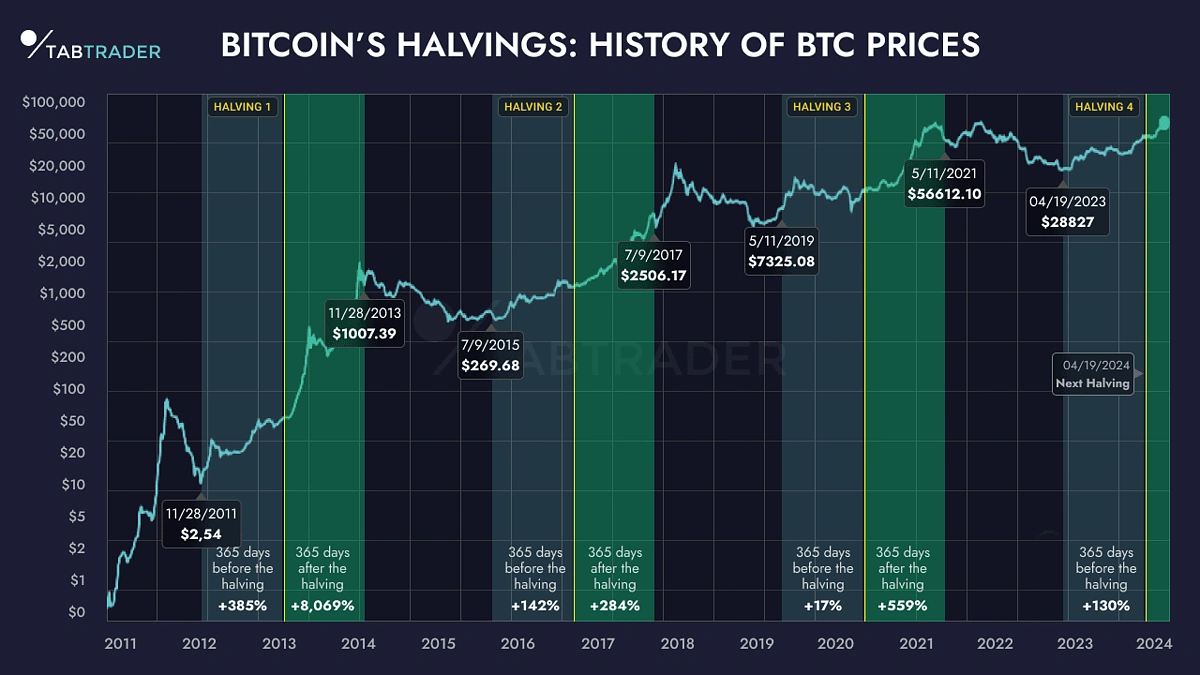

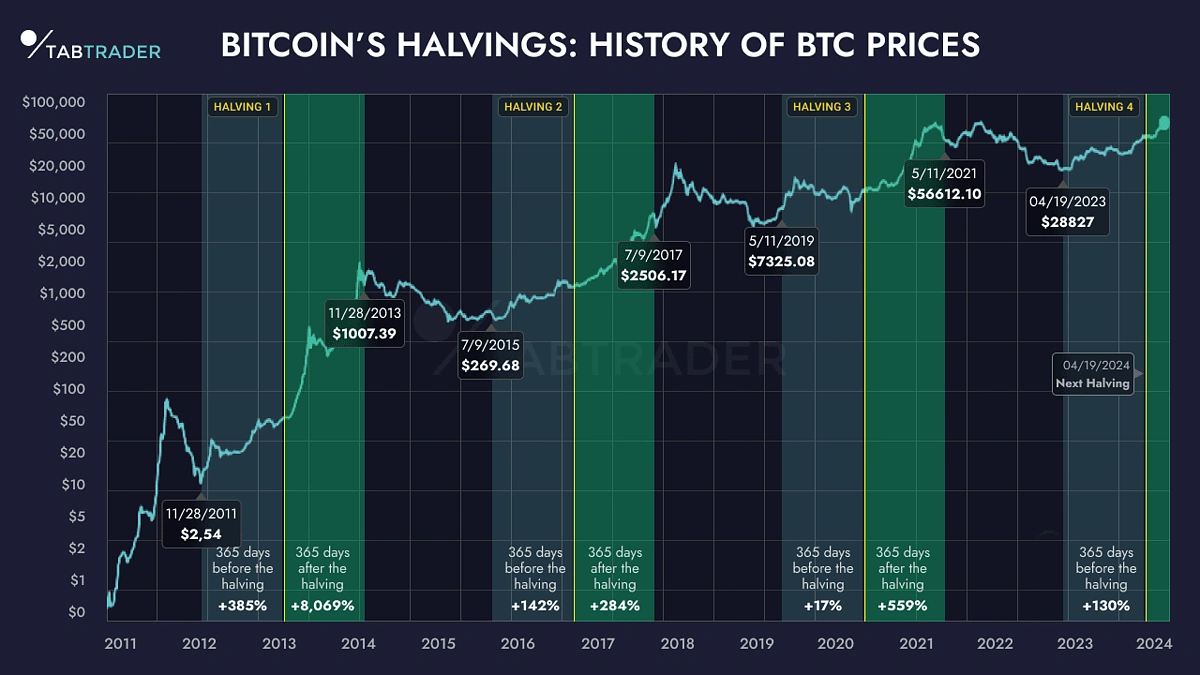

In the ever-evolving world of cryptocurrency, patterns and historical data often serve as guides for future market movements. Recently, a notable analyst known as “Quantum Ascend”...

Trading Cryptocurrency from Your Smartphone: A Beginner’s Guide With the rise of digital currencies, trading cryptocurrency has become more accessible than ever. Now, you can manage...

Understanding Cloud Mining Cloud mining allows individuals to participate in cryptocurrency mining without the need to own or maintain physical mining equipment. By renting computing power...

As we move through 2025, the cryptocurrency market is experiencing significant changes, largely influenced by increased institutional involvement and the introduction of exchange-traded funds (ETFs). These...

In April 2025, Liquity’s native token, LQTY, reached a low of $0.43. Since then, it has rebounded, trading around $1.00 by early July 2025. This recovery...