The cryptocurrency landscape is constantly evolving, with new projects emerging that aim to bridge the gap between traditional finance and digital assets. One such project gaining...

Crypto Mining and XRP Rewards: Simple Paths to Earning Every Day Interest in cryptocurrency investing and mining is growing fast, but most people think it’s too...

In the ever-evolving world of cryptocurrency, presales have become a popular avenue for investors seeking early access to promising projects. Two such projects, Pepeto and Pepe...

The cryptocurrency community is abuzz with excitement as BTCC, the world’s longest-operating crypto exchange, teams up with NBA All-Star Jaren Jackson Jr. to launch an exhilarating...

Ethereum (ETH), the world’s second-largest cryptocurrency, has been a focal point for investors and analysts alike. As of August 27, 2025, ETH is trading at $4,605.33,...

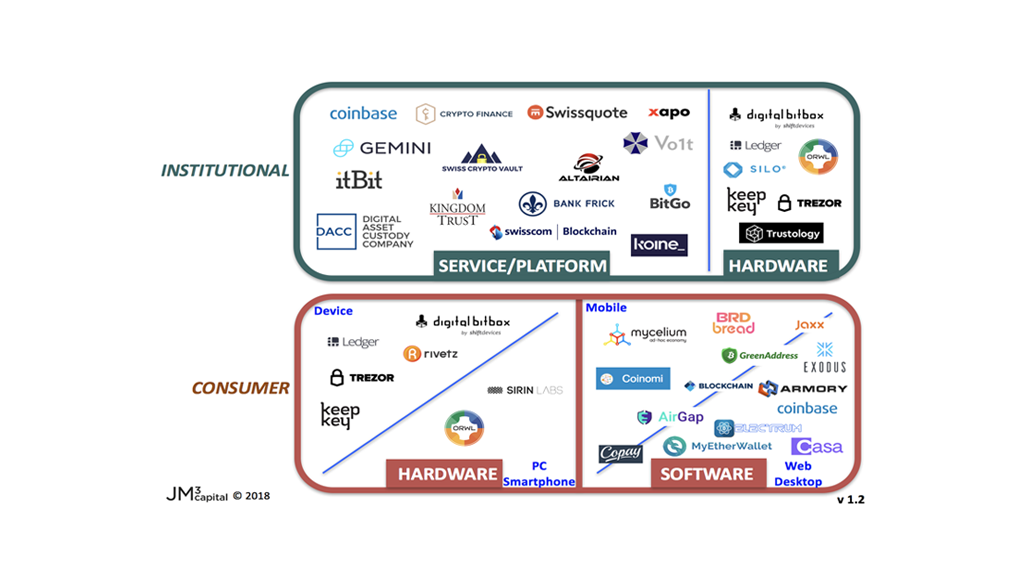

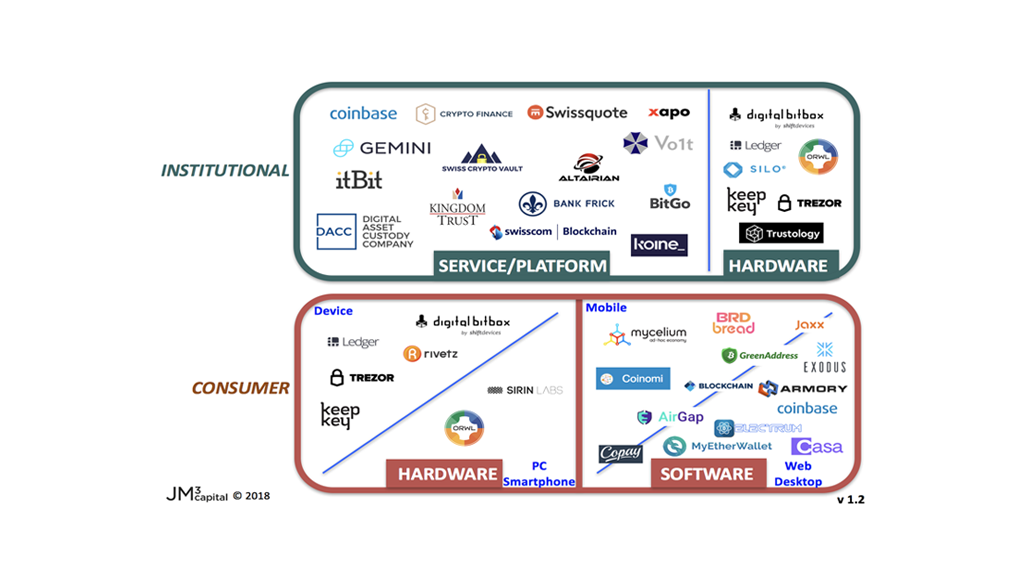

In August 2025, the landscape of cryptocurrency wallets has evolved significantly, emphasizing enhanced security and user control. Self-custodial wallets have become the preferred choice for many,...

Iran’s Cryptocurrency Landscape in 2025 Iran’s cryptocurrency landscape has faced significant challenges in 2025, marked by a notable decline in transaction volumes, a major security breach,...

Bitcoin’s Price Dip and the Impact of Whale Sell-Offs Bitcoin’s price has recently dipped below the $110,000 mark, a significant drop that has caught the attention...

Best Early-Phase Altcoins for 2025 Gains: Spotlight on Solana and MAGACOIN FINANCE The crypto market is stirring up new excitement as bold predictions and fast-moving coins...

In a significant move to bolster the security of digital asset custody, Binance, the world’s largest cryptocurrency exchange, is collaborating with Spain’s Banco Bilbao Vizcaya Argentaria...