Crypto money usually chases stories. In shaky markets, it chases working products. That simple shift explains why some large caps lose steam while “payments-first” tokens pull...

Crypto is red this week, and two crowd favorites — HYPE and Cardano — have slipped again. Yet one small-cap name keeps grabbing airtime: Digitap and...

WLFI pops as whales return — and USD1’s steady growth gives it a tailwind World Liberty Financial’s token (WLFI) just flipped the script. After tagging an...

Crypto just got a harsh reminder that leverage cuts both ways. After President Donald Trump threatened 100% tariffs on all Chinese imports on Friday, October 10,...

Binance Coin is back in the spotlight. After a fast climb, BNB is catching its breath around the mid‑$1,200s, with bulls eyeing the $1,400–$1,500 area and...

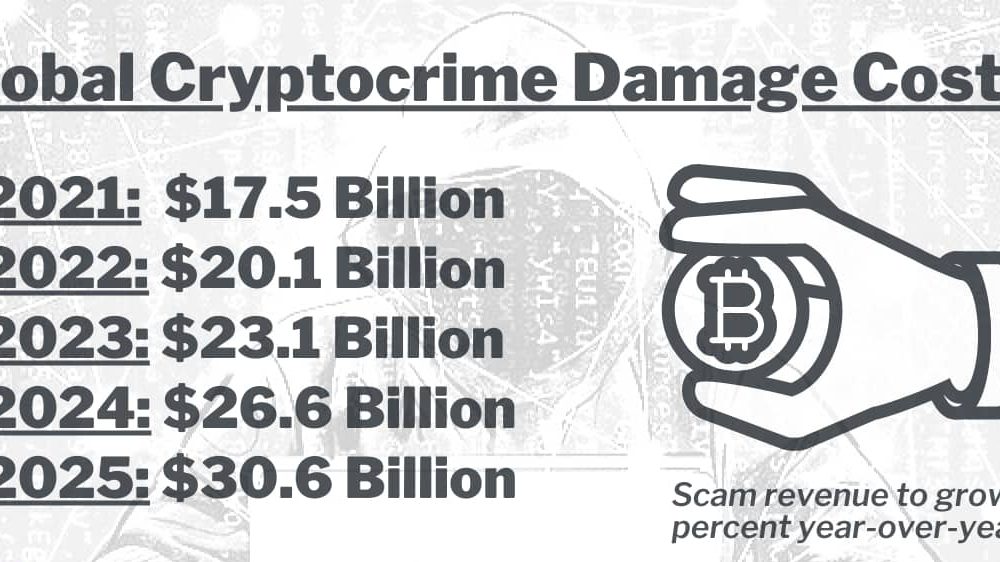

$75 Billion in Crypto Crime Spurs Global Law Enforcement Collaboration The digital currency landscape has witnessed a surge in illicit activities, with approximately $75 billion linked...

The cryptocurrency landscape is constantly evolving, with meme coins capturing significant attention due to their unique blend of community engagement and potential for substantial returns. Among...

In recent times, the cryptocurrency market has experienced notable fluctuations, with established coins like Cardano (ADA) facing challenges. ADA’s price has dipped below the $0.90 support...

As the cryptocurrency market gears up for a potential bullish run in 2025, investors are closely examining which assets might offer the most substantial returns. Among...

In 2025, the cryptocurrency market is witnessing a surge in interest towards cross-chain arbitrage technology. This innovative approach allows traders to exploit price differences of digital...