Injective Launches Native Ethereum Virtual Machine (EVM) Testnet Injective, a blockchain platform known for its focus on decentralized finance (DeFi), has recently launched its native Ethereum...

From Skepticism to Strategy: NYC Embraces Blockchain’s Civic Potential New York City is taking significant steps to integrate blockchain technology into its civic framework. This shift...

SoFi Technologies Reintroduces Cryptocurrency Trading and Blockchain Services SoFi Technologies, a prominent online banking and financial services company, is making a significant move by reintroducing cryptocurrency...

Ripple’s XRPL 2.5.0: Simple Changes with Big Goals for XRP Ripple has launched version 2.5.0 of the XRP Ledger (XRPL) and the upgrades could shift how...

In a surprising turn of events, Zohran Mamdani, a 33-year-old democratic socialist and state lawmaker, has emerged victorious in New York City’s Democratic mayoral primary, defeating...

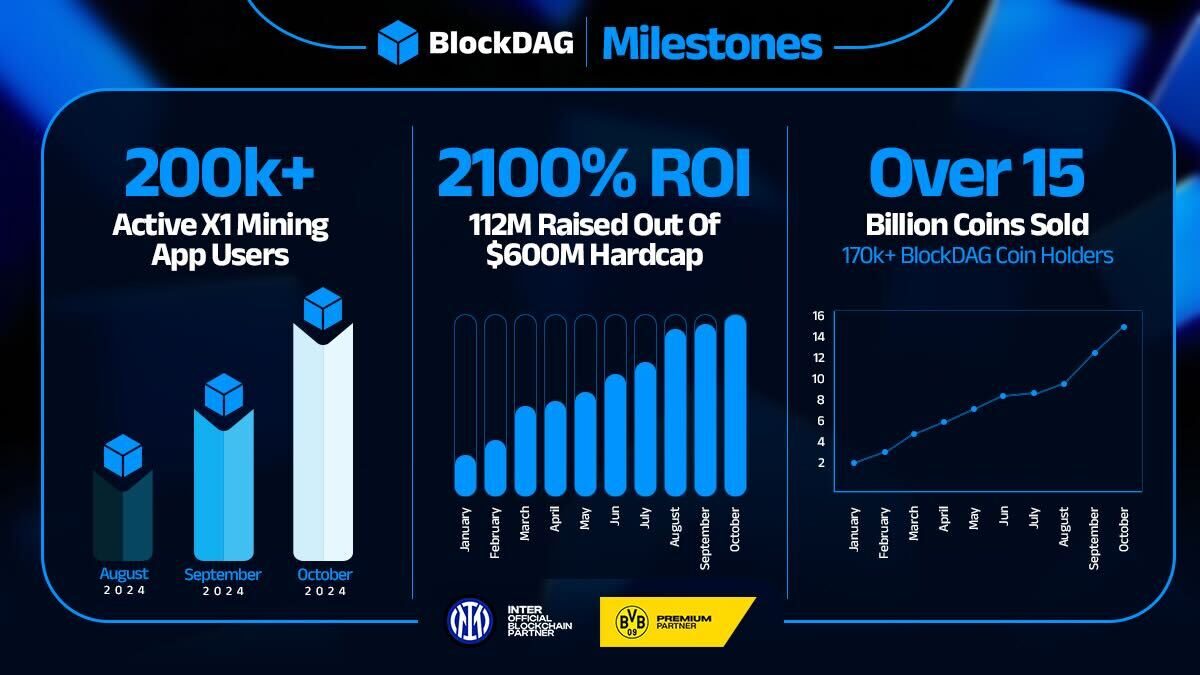

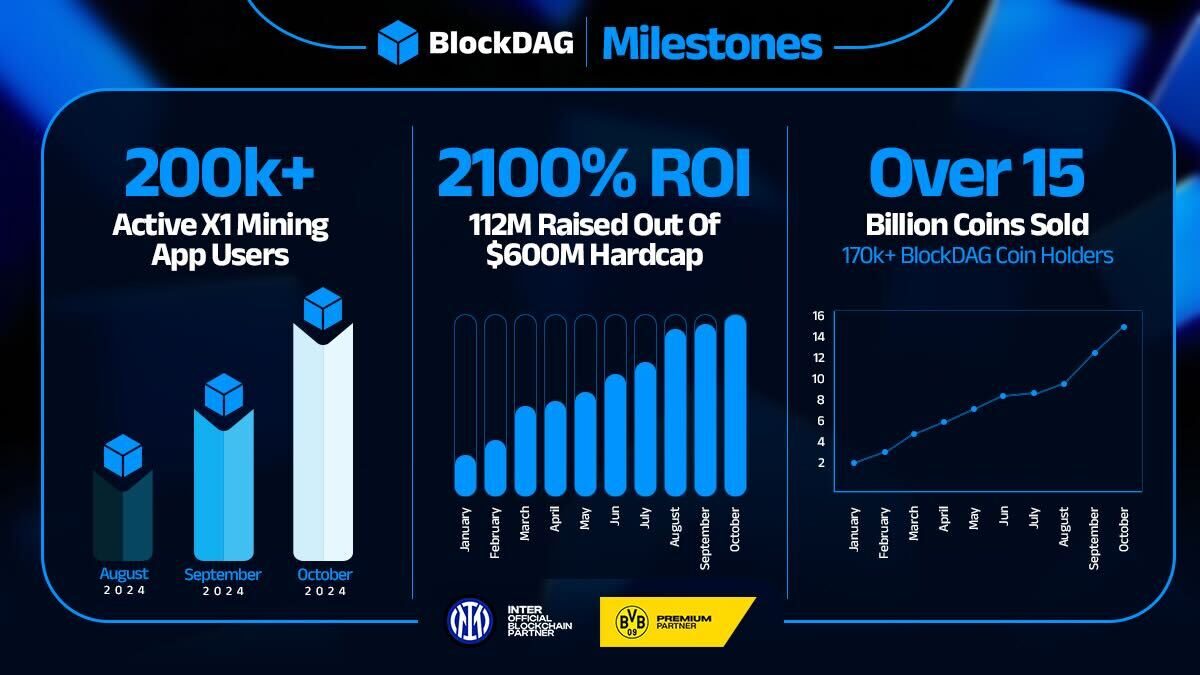

In the dynamic world of cryptocurrency, staying ahead means embracing innovation. While established platforms like Solana have set benchmarks in speed and scalability, a new player,...

In the ever-evolving world of cryptocurrency, a new player is capturing the attention of investors and analysts alike: Kaanch Network. This emerging blockchain platform is making...