Bitcoin is catching its breath. After a sharp selloff and an equally sharp rebound, trading activity has thinned out and price is moving in tight bands....

Europe’s biggest asset manager is getting ready to put Bitcoin on the menu for pensions, insurers and other large allocators. Reports in France say Amundi is...

Bitcoin’s reference software just changed how much “extra” data a transaction can carry — and the community is on fire about it. Supporters say it tidies...

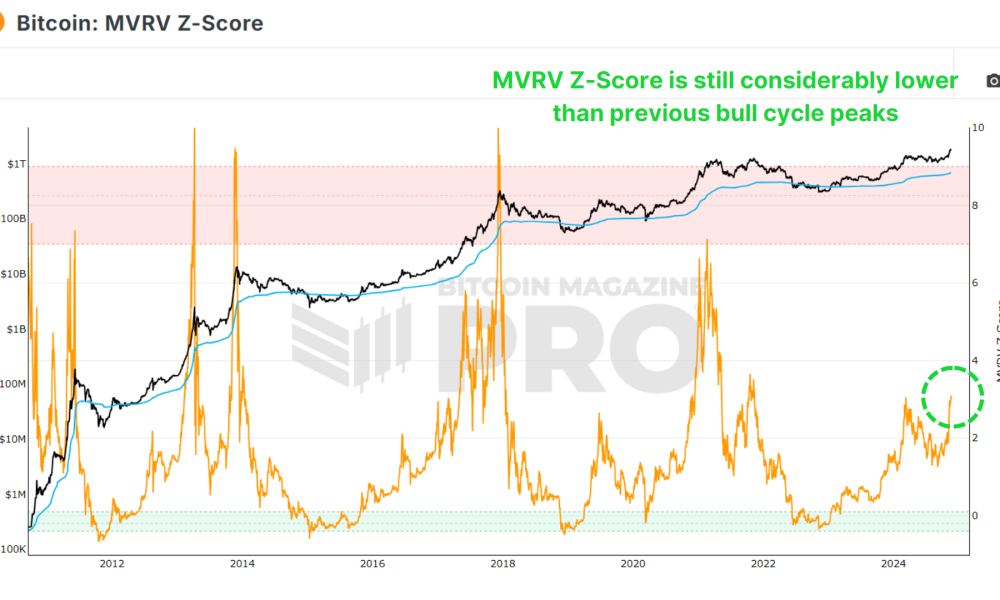

He called the October rug-pull. Now he’s calling a Q4 moonshot. After nailing this month’s sell-off, market watcher “Ash Crypto” is back with a bold call:...

Futures are cooling, options are still packed — and that mix can reshape how bitcoin moves. Around 2:50 p.m. ET on Monday, BTC chopped near $115,000...

How many sats do you actually need to stop working? “Number go up” is a meme, not a plan. Real retirement math needs assumptions you can...

The Future of Bitcoin Scalability and Layer-2 Solutions: A New Era for the World’s Oldest Crypto Bitcoin has traveled a long way since its quiet start...

Bitcoin’s Price Dip and the Impact of Whale Sell-Offs Bitcoin’s price has recently dipped below the $110,000 mark, a significant drop that has caught the attention...

How Will Europe’s New Bank Rules Affect Bitcoin Adoption in the EU? Bitcoin has been thrust once again into the spotlight, but this time for a...

Cloud Mining: A Beginner’s Guide and Top Platforms for 2025 Cloud mining has become a popular way for individuals to earn cryptocurrency without the need for...