Despite battling a sinus infection, George Clooney arrived at the Venice Film Festival premiere of Jay Kelly with Amal on his arm, determined not to miss...

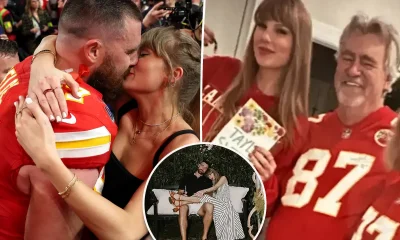

Ed Kelce says his son did things the traditional way: before proposing, Travis asked Taylor’s dad, Scott Swift, for his blessing. According to Ed, Scott’s reaction...

Leandro de Souza was once known as Brazil’s most tattooed man—more than 170 pieces spread across 95% of his body. Now, he’s documenting a reversal: laser...

New CCTV from Piopio, a rural town in New Zealand’s Waitomo District, appears to show fugitive father Tom Phillips and one of his children during a...

Kate Hudson closed the chapter on summer with an Instagram carousel that read like a sun-drenched scrapbook. Titled “So long sweet summer,” it stitched together boat...

The spark ignited at the US Open right after Taylor Townsend closed out a straight-sets win over Jelena Ostapenko. What should’ve been a routine handshake turned...

Under the fading glow of the Venetian sunset, George Clooney and his wife Amal made a graceful yet emotional exit from the 2025 Venice International Film...

The most intelligent dog breeds in the world: The results might surprise you For you, your fur baby is the goodest boy in the world. But...

This Saint-Tropez Yacht Photo Has 5 Million Views and Counting It started with one perfect photo. Sean McVay and Veronika Khomyn aboard their luxury yacht in...

The NFL offseason just got way nicer. Sean McVay’s name often makes headlines in the sports world, but this time, it’s his personal life drawing attention....