Europe’s biggest asset manager is getting ready to put Bitcoin on the menu for pensions, insurers and other large allocators. Reports in France say Amundi is...

Bitcoin’s reference software just changed how much “extra” data a transaction can carry — and the community is on fire about it. Supporters say it tidies...

DeFi has plenty of price feeds for coins and stocks. What it rarely gets is a clean read on real‑world odds — like the chance of...

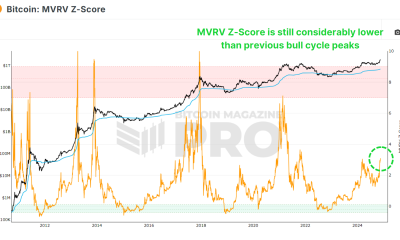

He called the October rug-pull. Now he’s calling a Q4 moonshot. After nailing this month’s sell-off, market watcher “Ash Crypto” is back with a bold call:...

Crypto just got a harsh reminder that leverage cuts both ways. After President Donald Trump threatened 100% tariffs on all Chinese imports on Friday, October 10,...

Futures are cooling, options are still packed — and that mix can reshape how bitcoin moves. Around 2:50 p.m. ET on Monday, BTC chopped near $115,000...

How many sats do you actually need to stop working? “Number go up” is a meme, not a plan. Real retirement math needs assumptions you can...

HYPE just did something many altcoins couldn’t this week: it held the line. After a choppy stretch across crypto, Hyperliquid’s token rebounded off the $44 area...

Binance Coin is back in the spotlight. After a fast climb, BNB is catching its breath around the mid‑$1,200s, with bulls eyeing the $1,400–$1,500 area and...

$75 Billion in Crypto Crime Spurs Global Law Enforcement Collaboration The digital currency landscape has witnessed a surge in illicit activities, with approximately $75 billion linked...