Ethereum (ETH) Market Overview Ethereum (ETH) has recently captured significant attention in the cryptocurrency market, especially following a notable increase in institutional investments. However, despite this...

Ethereum’s Price and On-Chain Activity Ethereum’s price has been hovering around the $2,500 mark, a level that has become a focal point for both investors and...

Trading Cryptocurrency from Your Smartphone: A Beginner’s Guide With the rise of digital currencies, trading cryptocurrency has become more accessible than ever. Now, you can manage...

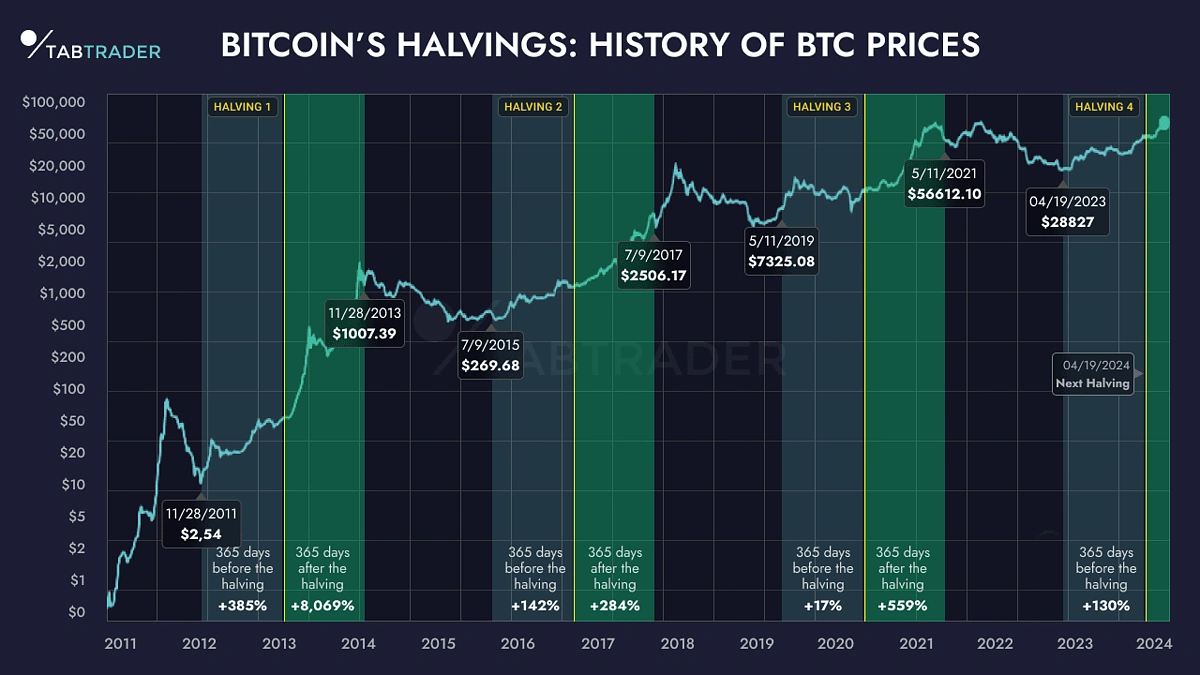

In recent years, Bitcoin exchange-traded funds (ETFs) have gained significant traction, attracting billions in investments and signaling a growing acceptance of cryptocurrency within traditional finance. As...

How the Fed’s Quiet Moves Stir Bitcoin’s Bullish Volatility What’s Happening Behind the Scenes The U.S. Federal Reserve is often at the center of conversations about...

Investors Track LetsBonk’s Rapid Rise as It Overtakes Pump.fun on Solana Meme Token Scene By CryptoNews Senior Editor A Surprising Shift Among Solana Launchpads The world...

Understanding Cloud Mining Cloud mining allows individuals to participate in cryptocurrency mining without the need to own or maintain physical mining equipment. By renting computing power...

The Cryptocurrency Market Surge and Political Developments The cryptocurrency market is experiencing a notable upswing, with altcoins like Dogecoin, Solana, and Ethereum leading the charge, while...

El Salvador’s Initiative in Artificial Intelligence El Salvador is making significant strides in artificial intelligence (AI) by launching its first national AI laboratory, powered by NVIDIA’s...

As we move through 2025, the cryptocurrency market is experiencing significant changes, largely influenced by increased institutional involvement and the introduction of exchange-traded funds (ETFs). These...