Crypto Golf Betting Tournaments: Where Blockchain Meets the Green Golf and cryptocurrencies may seem like an unlikely pair, but their combination is creating a stir in...

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has recently achieved a significant milestone by surpassing Johnson & Johnson, a global healthcare giant, in market value....

Ethereum and BlockchainFX: A Comparative Overview Ethereum has long been the go-to platform for smart contracts, enabling developers to build decentralized applications (dApps) and execute self-enforcing...

The NFL offseason just got a lot hotter. While most players and coaches are enjoying quiet time before the grind of training camp, Los Angeles Rams...

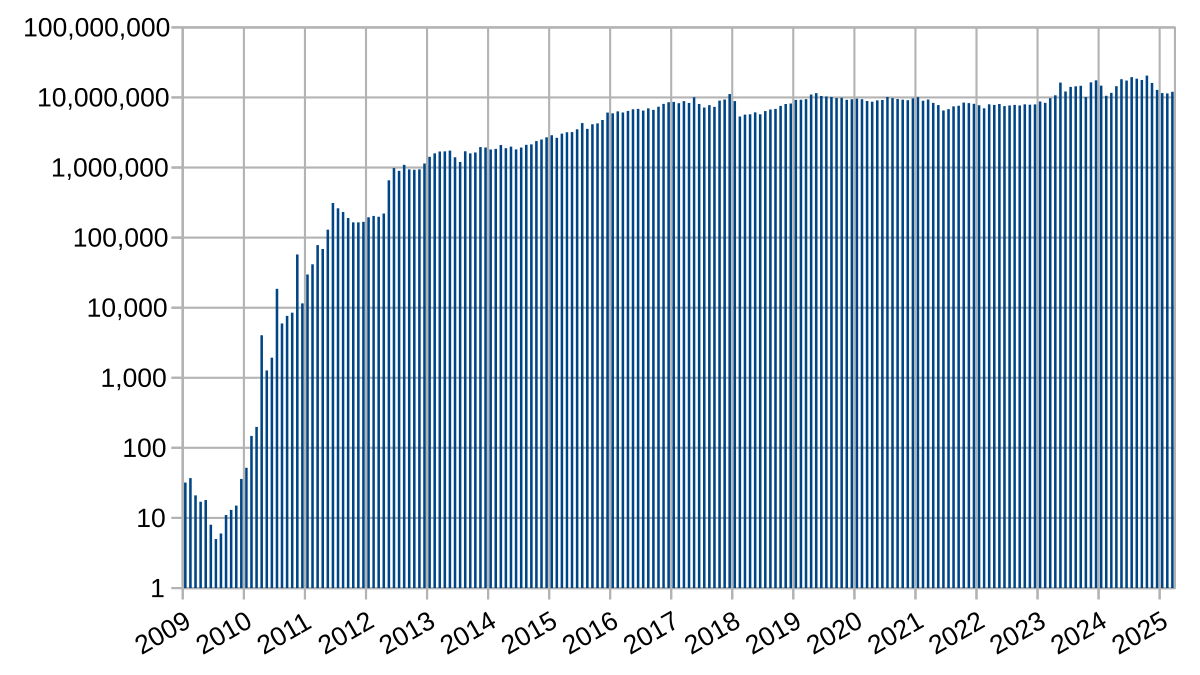

Stock market information for Bitcoin (BTC) Bitcoin is a crypto in the CRYPTO market. The price is 122351.0 USD currently with a change of 4454.00 USD...

Bitcoin has achieved a remarkable milestone, surpassing the $122,000 mark for the first time. This surge reflects growing confidence in the cryptocurrency market and highlights Bitcoin’s...

Bitcoin has reached a new milestone, surpassing $122,000 for the first time. This achievement has sparked discussions about the future of the cryptocurrency, with former Binance...

Bitcoin has recently surged past the $122,000 mark, sparking a wave of excitement across the cryptocurrency market. This rally has also lifted other major digital currencies...

Dogecoin (DOGE) Price Surge Overview Dogecoin (DOGE) has recently experienced a notable price increase, climbing over 5% in a late-session rally. This surge is largely attributed...

Bitcoin has recently surged past the $122,000 mark, setting new records and capturing the attention of investors worldwide. This remarkable ascent is closely linked to the...