Crypto

Gen Z Turns to Bitcoin Amid Economic Shift and Trust Issues

Published

6 months agoon

“`

Gen Z’s Growing Attraction to Bitcoin: A Simple Shift in How Young People Build Wealth

As traditional paths to financial security become more uncertain, more members of Gen Z are looking to Bitcoin as a fresh alternative. The reasons are personal, practical, and deeply tied to the changing world they see around them.

Why Gen Z Feels Stuck

For many in Gen Z—those born from the late 1990s to the early 2010s—the idea of job security and homeownership feels out of reach. AI is reshaping the job market, and the cost of college, rent, and starter homes keeps rising. According to Jordy Visser, a Wall Street veteran, the ongoing boom in tech and finance is helping some, but it’s leaving a lot of young people behind. “They’re just saying we’re not going to hire as much, which means going forward, the people that are going to be hired are going to be digital employees,” Visser said in a recent interview.

This change is more than economic. It’s personal. Many young adults watch their parents retire comfortably and wonder if they will ever have the same chance. Hopes of climbing a “career ladder” or buying a first home feel distant. What stands in their way? The answer is complicated but includes rising living costs, heavy student debt, and growing distrust in traditional money systems like the US dollar.

AI and the Economy: More Questions Than Answers

Artificial intelligence isn’t just a buzzword—it’s making a real difference in how companies hire and what work looks like. As more tasks become automated, fewer traditional jobs are available. While technology promises new opportunities, it’s also a source of anxiety because it’s not clear what kinds of jobs will be left.

As AI pushes companies to hire “digital employees” (robots or software doing jobs people used to do), many young adults see their future as uncertain. No wonder some are searching for other ways to secure their financial future.

“The younger people don’t have a belief that the system will come back. They believe the system has been worsening every single year… That entire path is gone [get a job, move up, buy a house]. And that’s why the students are so angry and why socialism is happening. So, I think where Bitcoin fits into it,” Visser explained.

Political Uncertainty and Distrust in Banks

Another concern for Gen Z: Political decisions and pressure on the Federal Reserve make America’s money system feel shaky. When politicians push the Fed to cut interest rates, it creates fears about inflation and the dollar’s long-term value. Many young adults have lost faith that the “old ways” of saving and investing (like putting money in a savings account or the stock market) will keep up with inflation or survive another big financial crisis.

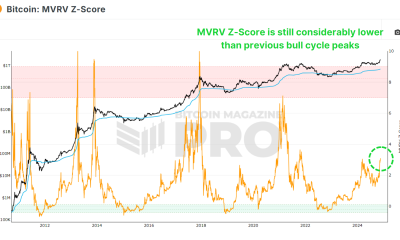

Bitcoin: A Different Kind of Asset

Against this background, Bitcoin starts to look more appealing. It isn’t tied to any government or traditional bank. It can’t easily be inflated or controlled by a central authority. And, maybe most importantly, it feels “owned” by the person holding it—no bank account or approval needed to get started.

- Low entry requirements: Anyone can buy a piece of Bitcoin, even with small amounts of money.

- Portability: Bitcoin can be sent quickly to anyone in the world, as long as they have internet access.

- Personal control: Holders manage their own Bitcoin directly, rather than trusting a bank.

- Decentralized: Bitcoin works through a global network, so it doesn’t rely on any single institution.

Young people are aware of risk—but they see risk in traditional assets too. With stocks and real estate feeling tied to an old, changing system, a digital “hard asset” like Bitcoin looks like a way to try something new.

Bitcoin and the “New American Dream”

For older generations, the American Dream often meant buying a house and having a steady job. For many Millennials and Gen Z, that’s changing. Some of their heroes in the crypto world—like Binance’s former CEO “CZ” and Michael Saylor, a well-known Bitcoin advocate—have even suggested that owning just a small portion of a Bitcoin may someday be as meaningful as owning a home.

Jeff Park, portfolio manager at Bitwise, suggests this is more than just a trend: “Owning a full Bitcoin is starting to replace homeownership as a symbol of financial freedom for Millennials and Gen Z.”

Regulators are starting to catch on, too. The Federal Housing Finance Agency (FHFA) recently announced that crypto assets like Bitcoin could soon be used to assess home loan applications. This means Bitcoin is becoming even more recognized as a “real” part of a young adult’s wealth.

What Makes Bitcoin Attractive to Gen Z?

- Speed and Access: Anyone with a smartphone can participate. No paperwork, no bank visits, no waiting for business hours.

- Transparency: Everyone can see the transactions—no hidden rules and no middleman taking a cut.

- Independence: Bitcoin gives young people a way to “opt out” of banks or traditional money systems they don’t believe in.

This doesn’t mean every young adult is turning to Bitcoin, but for those who feel locked out of old pathways to wealth, it represents a real option. It fits with their digital-first lives, desire for control, and need for new ways to grow their money.

The Future: More Than Hype?

For Gen Z, Bitcoin is not just an investment, but a bet on a different future. They aren’t rejecting the “old system” just for fun—they’re responding to a world where long-standing promises feel broken. Whether or not Bitcoin is the best answer, the fact that so many young people are choosing it says a lot about what they want: fairness, transparency, and a real shot at building something of their own.

The story of Gen Z and Bitcoin is not just about money. It’s about hope, frustration, and the search for a sense of ownership in a world that’s changing faster than ever.

Read more on this topic: How Social Discontent Could Drive Gen Z Toward Bitcoin

“`

also read:Wintermute Secures Bitcoin-Backed Credit Line with Cantor Fitzgerald to Boost Market Liquidity

You may like

-

Bitcoin Price Consolidation Ahead of Potential Breakout: Volume and Range Analysis

-

European Asset Managers Signal Growth in Bitcoin via Institutional Products Amid Inflation Concerns

-

Bitcoin v30 Upgrades OP_RETURN Data Limit to 100KB: What Investors Need to Know

-

Crypto Analyst Predicts Q4 Bitcoin Rally to $180000 Amid Altcoin Surge

-

What Heavy Bitcoin Options Exposure Means for Traders and Price Movements

-

Bitcoin Retirement Planning: How Many Sats Do You Need To Secure Your Future?

Crypto

Market Pattern Reversal: SUI Wave 4 Shakeout Sparks Trader Debates

Published

2 weeks agoon

November 29, 2025

SUI just pulled off a textbook bounce, but it’s doing it in the riskiest part of the map. Traders tracking Elliott Wave counts say price is inside Wave 4 of a bigger bearish sequence — the spot where rallies look convincing right before the market makes up its mind.

From here the coin either clears resistance and signals a trend shift, or it rolls over into a final Wave 5 to finish the downside pattern. The next few levels matter more than the last few headlines.

Why “Wave 4” Has Traders On Edge

In Elliott Wave terms, Wave 4 sits between a sharp selloff (Wave 3) and a possible final drop (Wave 5). It often retraces part of Wave 3, chops sideways, and fakes out both bulls and bears. The move can be shallow or surprisingly deep, and it tends to be messy: triangles, flats, expanded flats — the type of price action that punishes impatience.

For investors who don’t live on trading desks, the takeaway is simple: a Wave 4 rally is not the same as a fresh uptrend. You usually need either a clear break of key resistance or a completed five-wave push up in the lower timeframes before calling a bottom with any confidence.

What Just Happened On SUI

According to a fresh update from the analyst behind More Crypto Online, SUI snapped higher from the 100% extension area around $1.41 — a level that has acted as support on the chart. That bounce is the first meaningful pushback from buyers after the latest leg down, and it puts price on a path toward a heavy resistance band between $1.68 and $2.21. The analyst stresses that Wave 4 retracements can vary a lot, so price may swing through that entire range before the market shows its hand. You can find the analyst’s note here: More Crypto Online on X.

Here’s the key line in the sand: a decisive break above $2.21 would argue that the upside has carved out a complete five-wave structure, raising the odds that a durable bottom is already in place. Until that happens, the broader bearish setup stays on the table and the recent rally counts as a counter-trend move inside Wave 4.

The Bull Case: Reclaim $2.21 And Hold

Bulls want to see a strong push through $2.21 backed by rising spot volume, a shift in lower-timeframe structure (higher highs and higher lows on the 4-hour and daily), and momentum indicators breaking their downtrend lines. Follow-through matters: one wick above resistance isn’t enough if the next candle hands it back.

If the break sticks, it would suggest the market has already finished a five-wave move up from the lows, which often precedes a larger trend reversal or at least a deeper corrective climb. That would also reduce the probability of a new low and invite dip buyers to step in on pullbacks toward the prior resistance band.

The Bear Case: Rejection In The Zone Sets Up Wave 5

If SUI prints a clean rejection anywhere between $1.68 and $2.21 — think long upper wicks, momentum diverging, and breakdowns after liquidity sweeps — the Wave 4 top is likely in. That would set expectations for a final leg down into Wave 5 to complete the larger C-wave decline that the analyst is tracking. Under that path, the market aims to take out the prior low, form a base, and only then kick off a sturdier recovery.

Bitcoin’s Shadow Still Looms

The More Crypto Online view lines up with Bitcoin’s current posture: a three-wave corrective rebound that leaves room for another low before a larger move higher. When BTC is at risk of one more dip, high-beta altcoins like SUI often echo the move with sharper swings. If BTC undercuts its recent low after a corrective bounce, SUI’s Wave 5 scenario gains traction. If BTC reclaims key levels and holds them, the probability of SUI beating $2.21 improves.

Levels And Signals That Matter Right Now

- $1.41 — The extension area that caught buyers. Staying above keeps the bounce alive; losing it would hint the Wave 4 attempt is fading.

- $1.68–$2.21 — Thick resistance and the typical battleground for Wave 4. Expect fakeouts, spikes, and abrupt intraday reversals in this zone.

- $2.21 — The trigger that could shift the narrative from “counter-trend rally” to “bottom may be in.” Bulls need strength through this level and constructive retests.

Beyond levels, watch positioning. If funding rates jump while price stalls into resistance, that’s often a warning that longs are crowding the same idea. A reset in open interest after a shakeout, followed by a steady rebuild on a break above $2.21, would be a healthier look for the bull case.

How Traders Are Framing It

Range Tactics For Wave 4

- Fade extremes, respect invalidation. In a wavering range, short-term traders often sell into the top of the zone and buy dips near support, but they cut quickly if price breaks out with force.

- Wait for confirmation. Break-and-retest patterns around $2.21 can offer cleaner entries than guessing the exact Wave 4 peak or bottom.

- Mind the clock. Wave 4 phases can drag on. Time-based stop rules or smaller position sizes can help reduce the pain of chop.

Spot Buyers With A Longer View

- Scale, don’t chase. If you’re building a position, stepping in gradually near support and keeping dry powder for bigger dips can limit regret.

- Track network progress. Token prices follow narratives in the medium term. Ecosystem growth, developer traction, and on-chain activity matter for SUI once the chart finishes its corrective business.

- Use simple risk guards. A weekly close under recent lows often signals that patience, not heroics, is the better plan.

What Could Flip The Script Outside Pure TA

Wave counts map crowd behavior, but catalysts can force a re-marking of levels. Major ecosystem partnerships, core protocol upgrades, large token unlocks, or exchange listings have a habit of compressing time. Any surprise that tightens supply or pulls real usage can help the $2.21 break stick. Any event that adds supply or knocks confidence can turn a routine rejection into a fast slide toward fresh lows. Keep an eye on basic market data for SUI to gauge liquidity and turnover during these moves; sites like CoinMarketCap can help with that snapshot.

Common Pitfalls In Wave 4

- Confusing first bounce with a new trend. Early rallies inside Wave 4 often retrace abruptly.

- Ignoring context. If BTC is wobbling, altcoin breakouts have lower odds of follow-through.

- Overstaying after a tag of resistance. Many Wave 4s end with sharp rejections right where the textbook says they might.

The Bottom Line

SUI’s rebound off $1.41 sets the stage for a bigger decision. The resistance stack at $1.68–$2.21 is where that decision likely gets made. A clean push and hold above $2.21 would tip the scales toward a bottom already in place; a sharp rejection inside the zone would point to a final Wave 5 lower to complete the pattern the analyst is tracking. That road map also lines up with Bitcoin’s setup, which still leaves room for one more swing down after a three-leg recovery.

If you’re active here, keep it simple: respect the levels, wait for confirmation, and let the market show you whether this is the start of something bigger or just the last head fake before the real low. For day-to-day updates on the Elliott count referenced above, see the post from More Crypto Online.

also read:Sui Blockchains DeFi Platform Grows as Traders Target $5 Level

Crypto

How Practical Use Shapes Crypto Prices: Insights from ADA and Remittix

Published

2 weeks agoon

November 29, 2025

Crypto money usually chases stories. In shaky markets, it chases working products. That simple shift explains why some large caps lose steam while “payments-first” tokens pull fresh bids.

This week, Cardano’s ADA stayed heavy near multi‑month lows, even with a privacy sidechain event on the calendar. At the same time, Remittix (RTX) drew buzz by pointing to an iOS wallet and audits—exactly the sort of “show, don’t tell” investors reward when sentiment cools.

Utility is starting to price in

When liquidity thins, traders gravitate toward things they can actually use: wallets that move value, apps that settle invoices, rails that link crypto to bank accounts. That’s not a moral judgment on tech roadmaps; it’s a practical one. Capital rotates to where catalysts touch real users—downloads, transactions, and integrations—because those milestones can land even when prices drift.

Context: ADA stalls as the market asks for catalysts

On Saturday, November 29, 2025 (ET), ADA traded around $0.417 after an intraday range near $0.414–$0.434. Sellers have kept rallies brief for weeks, a sign that buyers want clearer triggers before taking risk.

One near‑term storyline for the Cardano crowd is Midnight, a data‑protection sidechain with its own token. Cardano’s founder Charles Hoskinson has said the NIGHT token launch is slated for December 8, 2025, with distribution and trading planned to start the same day. Dates matter in crypto; a confirmed calendar can tighten spreads and lift volumes—if usage follows. ([kucoin.com](https://www.kucoin.com/news/flash/cardano-founder-announces-night-token-launch-on-december-8-2025?utm_source=openai))

Event: “Payments you can touch” pulls attention to Remittix

The rotation narrative accelerated after coverage highlighting Remittix as a PayFi project raising tens of millions during its token sale. CoinCentral reported on November 29 that RTX had crossed $28.2 million raised, framing the shift as interest moving toward blockchains with tangible use. Treat it as marketing heat, but it shows where traders’ eyes are. ([coincentral.com](https://coincentral.com/cardano-price-prediction-ada-weakens-while-capital-rotates-toward-remittix/?utm_source=openai))

Beyond presale numbers, there are two claims investors can verify today. First, the Remittix Wallet is listed on Apple’s App Store, positioned as a crypto wallet aiming to support payouts into bank accounts. A listing does not validate every feature, yet it is a public checkpoint you can independently check. ([apps.apple.com](https://apps.apple.com/app/remittix-wallet/id6747745484?utm_source=openai))

Second, there is a CertiK page for Remittix Labs. The audit entry, dated July 2025, shows no critical or major issues on the reviewed contract and a “Bronze” team verification tier at the time of the snapshot. That’s different from social media claims of a top‑tier grade; read the page details rather than the headline. ([skynet.certik.com](https://skynet.certik.com/projects/remittix-labs?utm_source=openai))

Remittix itself says it has a centralized‑exchange path lined up (BitMart) and has promoted presale tallies via press releases throughout Q3–Q4. Company press releases are one‑sided by nature, so weigh them like you would a startup’s pitch deck: useful signals, not proof. ([globenewswire.com](https://www.globenewswire.com/news-release/2025/08/20/3136687/0/en/Remittix-Presale-Skyrockets-Past-20M-After-Revealing-First-Major-Exchange-Listing-With-More-To-Follow.?utm_source=openai))

Signal vs. noise: how to separate “real utility” from hype

Utility should leave data trails. Before rotating from a large cap into a payments token, match the story to evidence you can cross‑check:

- Product reality: Is there a live app in a mainstream store? What do the version history, permissions, and reviews say over multiple updates? App Store listings are a start, not the finish line. ([apps.apple.com](https://apps.apple.com/app/remittix-wallet/id6747745484?utm_source=openai))

- Compliance breadcrumbs: For crypto‑to‑fiat payouts, who are the licensed partners in each country? Are money transmitter or EMI partners named anywhere official?

- Security receipts: Read the audit PDF. Note counts of critical/major issues and whether the team completed a KYC tier. Check re‑evaluations over time on CertiK Skynet. ([skynet.certik.com](https://skynet.certik.com/projects/remittix-labs?utm_source=openai))

- Liquidity reality: If an exchange listing is touted, does the exchange confirm it? After listing, watch order‑book depth, not just a candle.

- On‑chain use: Are people transacting beyond the presale contract? Look at unique addresses, retention, and whether merchants or apps actually integrate it.

The other side of the ledger: community red flags

Any fast‑rising presale draws skeptics—and sometimes for good reason. Across 2025, multiple Reddit threads flagged delayed token delivery and support issues around Remittix purchases. Forum posts are anecdotal and not proof of wrongdoing, but they are a reminder to size risk and wait for verifiable milestones before going heavy. ([reddit.com](https://www.reddit.com//r/CryptoScams/comments/1is01d2?utm_source=openai))

What this means for ADA holders weighing a rotation

ADA is still a large network with an active research pipeline and a fresh catalyst dated for December 8 via Midnight’s token event. That could help short‑term sentiment if it translates into developer activity and new dapps shipping on a clear timeline. Until that happens, price action looks tired, and traders are rewarding projects that put utility in users’ hands today. ([kucoin.com](https://www.kucoin.com/news/flash/cardano-founder-announces-night-token-launch-on-december-8-2025?utm_source=openai))

If you’re considering a partial rotation, set a high bar for evidence. For Remittix, that means confirming the wallet’s core features with small test amounts, watching for named banking/payment partners, and verifying any exchange listings directly with the exchange. Treat presale totals and paid media as marketing, not validation. For ADA, track whether Midnight’s launch leads to live apps that grow users or TVL on Cardano rather than only token distribution events. ([apps.apple.com](https://apps.apple.com/app/remittix-wallet/id6747745484?utm_source=openai))

Price‑sensitive checklist investors can use now

- Dates and delivery: Midnight’s NIGHT token date is December 8, 2025. Watch whether activity on Cardano moves after that or if enthusiasm fades. ([kucoin.com](https://www.kucoin.com/news/flash/cardano-founder-announces-night-token-launch-on-december-8-2025?utm_source=openai))

- ADA levels: Keep an eye on how price behaves around $0.40–$0.44. Trend changes often start with ranges breaking on volume, not tweets.

- Payments reality: If a project claims crypto‑to‑bank rails in 30+ countries, there should be fine print and partner names. Absence of detail is a data point.

- Security and team: Cross‑reference audits and team verification tiers over time. Bronze verification is not the same as full KYC with public identities. ([skynet.certik.com](https://skynet.certik.com/projects/remittix-labs?utm_source=openai))

- Community health: Scan for unresolved support complaints. A stream of token‑delivery tickets is a warning sign, especially before TGE. ([reddit.com](https://www.reddit.com//r/CryptoScams/comments/1is01d2?utm_source=openai))

Investor angle: where utility can move price next

Real‑world utility compresses the gap between a roadmap and revenue. In crypto, that tends to show up as steadier demand, less slippage on dips, and better recovery after pullbacks. ADA can still benefit from that effect if Midnight spurs new use cases and if stablecoin infrastructure on Cardano firms up. The flip side: smaller payments projects can outperform for a stretch if they convert headlines into active users—though they carry higher execution and counterparty risk. ([coincentral.com](https://coincentral.com/cardano-price-prediction-ada-weakens-while-capital-rotates-toward-remittix/?utm_source=openai))

Takeaway

Markets are voting for utility right now. If you hold ADA, the near‑term test arrives on December 8. If you’re eyeing Remittix or any payments token, demand receipts: working features, named partners, confirmed listings, and clean audits with clear team disclosures. Rotate toward what you can verify—and let the price follow the product, not the other way around. ([kucoin.com](https://www.kucoin.com/news/flash/cardano-founder-announces-night-token-launch-on-december-8-2025?utm_source=openai))

also read:Digitaps $TAP Token Sparks Interest Amid Crypto Payment App Launch

Crypto

Impact of US Stablecoin Regulations on Global Financial Infrastructure

Published

2 weeks agoon

November 29, 2025

Opinion: Stablecoins and the new fight for monetary influence

Stablecoins have quietly turned the U.S. dollar into 24/7 software. With Washington now writing a rulebook for “digital dollars,” the stakes go far beyond crypto prices. The way the U.S. regulates stablecoins could decide who sets the standards for the next phase of global finance—and who benefits from the fees, the data, and the network effects.

Why Washington’s new rulebook matters

On July 18, 2025, the United States signed the GENIUS Act into law. The statute requires payment stablecoins to be fully backed by high‑quality liquid assets, with regular public disclosures and compliance obligations that look and feel like mainstream finance. In blunt terms: if you want to issue a dollar stablecoin to Americans, you need bank‑grade reserves, transparency, and controls. Lawmakers framed it as both consumer protection and a way to protect the dollar’s reach in the digital era. ([reuters.com](https://www.reuters.com/legal/government/trump-signs-stablecoin-law-crypto-industry-aims-mainstream-adoption-2025-07-18/?utm_source=openai))

What the law changes on the ground

- Clear federal standards for backing and redemption should reduce “who can I trust?” risk for users and merchants.

- Monthly reserve reporting and supervisory oversight push issuers toward Treasuries, cash, and repos—assets that settle cleanly and can be audited.

- Wider eligibility for issuers (banks and non‑banks) opens the door for payments firms and fintechs to plug stablecoins into everyday commerce and payroll.

For crypto investors, that clarity matters. Compliance costs rise, but so does the chance that large enterprises, card networks, and banks integrate stablecoins directly into their systems. In other words, fewer gray areas and more real‑world pipes.

The dollar’s digital export

Most active stablecoins are still pegged to the U.S. dollar, and their total market value recently topped $300 billion. That makes stablecoins one of the largest digital asset categories by far and a bigger “dollar channel” than many correspondent‑banking corridors. According to coverage of DeFiLlama data, the combined stablecoin market cap crossed the $300 billion mark in October 2025. ([finance.yahoo.com](https://finance.yahoo.com/news/stablecoin-market-cap-surpasses-300-123818109.?utm_source=openai))

Utility is catching up to market value. A report cited by CryptoSlate estimated stablecoin transfers hit $27.6 trillion in 2024—outpacing Visa and Mastercard combined on transfer value. Even if a chunk of that is market‑making and arbitrage, it shows how “tokenized dollars” are becoming the default settlement asset across crypto and bleeding into commerce. ([cryptoslate.com](https://cryptoslate.com/stablecoins-surpass-visa-and-mastercard-with-27-6-trillion-transfer-volume-in-2024/?utm_source=openai))

Treasuries, reserves, and the demand loop

Rule‑driven reserves create a feedback loop. If well‑regulated issuers must hold safe, short‑dated assets, every dollar of stablecoin supply tends to pull demand toward U.S. Treasury bills and cash‑like instruments. Tether’s own disclosures showed roughly $97–98 billion of T‑bills on its balance sheet in 2024–2025, placing it among the largest non‑sovereign holders. That kind of demand can matter at the margin for funding costs and liquidity in the front end of the curve. ([investopedia.com](https://www.investopedia.com/stablecoin-issuer-tether-reports-us-treasury-stash-first-half-of-2024-8686758?utm_source=openai))

Regulated issuers such as Circle structure reserves through a registered government money market fund that holds short‑dated Treasuries and overnight repo, with daily transparency. That set‑up aligns neatly with the GENIUS Act’s push for predictable collateral, and it’s easier for banks and corporates to plug into. Circle’s public reserve page explains the approach. ([circle.com](https://www.circle.com/transparency?utm_source=openai))

Europe is building its own pipes

Across the Atlantic, MiCA—the EU’s framework for crypto assets—already applies to stablecoins (classed as e‑money tokens and asset‑referenced tokens). From June 30, 2024, issuers seeking public offering or trading in the EU must meet MiCA’s authorization and reserve requirements, with supervisors phasing in oversight and reporting. That means any “global” stablecoin strategy now has to think in terms of both U.S. law and EU e‑money rules. ([eba.europa.eu](https://www.eba.europa.eu/publications-and-media/press-releases/eba-encourages-timely-preparatory-steps-towards-application?utm_source=openai))

The euro answer: bank‑backed and regulated

In September 2025, nine major European banks—including ING, UniCredit, CaixaBank and others—announced a consortium to issue a MiCA‑compliant euro stablecoin, targeting first issuance in the second half of 2026. The plan: a supervised e‑money institution in the Netherlands and bank‑grade controls from day one. This is Europe saying, “we want our own on‑chain money, and we want it to behave like bank money.” ([ing.com](https://www.ing.com/Newsroom/News/Nine-major-European-banks-join-forces-to-issue-stablecoin.htm?utm_source=openai))

Asia’s play: licensing and CBDC‑adjacent experiments

Hong Kong passed a licensing regime for fiat‑referenced stablecoins in May 2025, with the Hong Kong Monetary Authority signaling that the first licenses are likely early next year. Several joint ventures—some involving global banks—are already queuing up. The city’s central bank is also experimenting with e‑HKD and tokenized deposits to standardize interoperability. The takeaway: Asia is not waiting for Washington or Brussels to define everything. ([reuters.com](https://www.reuters.com/world/asia-pacific/hong-kong-passes-stablecoin-bill-one-step-closer-issuance-2025-05-21/?utm_source=openai))

So who sets the standards?

All roads point to a common theme: standards will follow scale and regulatory clarity. The U.S. has the dollar and a fresh federal framework; Europe has MiCA and a bank‑led euro initiative; Hong Kong is formalizing a license path and testing wholesale use cases. The more compliant rails exist, the more corporates will route payments, trade settlement, and collateral through those rails. That’s how “digital dollars” and “digital euros” can become the default settlement layer for tokenized assets and cross‑border money.

Investor angle: what to watch next

1) Which issuers get licensed first—and where

Early U.S. permit holders under the GENIUS Act and EU‑authorized EMT issuers under MiCA will set the bar for disclosures, redemption windows, and integration with banks. Expect spreads and peg stability to track issuer quality. ([reuters.com](https://www.reuters.com/legal/government/trump-signs-stablecoin-law-crypto-industry-aims-mainstream-adoption-2025-07-18/?utm_source=openai))

2) Reserve mix and yield passthrough

With rates still meaningful, the reserve mix (T‑bills, repo, cash) drives issuer earnings. Some models share yield with users (via tokenized funds or rewards), others don’t. That can influence where wallets, exchanges, and merchants route flows. ([investopedia.com](https://www.investopedia.com/stablecoin-issuer-tether-reports-us-treasury-stash-first-half-of-2024-8686758?utm_source=openai))

3) On‑chain settlement rails

Watch where regulated dollars actually move: Solana, Ethereum L2s, and bank‑permissioned networks all compete on speed, cost, and uptime. The chain that processors and PSPs standardize on tends to win merchant acceptance.

4) Europe’s bank coin timeline

If the euro stablecoin ships on schedule in H2 2026 and plugs into treasury, custody, and core payments inside participating banks, you’ll likely see European corporates start settling invoices and securities in a native euro token—less FX slippage, tighter cutoffs. If delays stack up, dollar tokens will keep filling that role. ([ing.com](https://www.ing.com/Newsroom/News/Nine-major-European-banks-join-forces-to-issue-stablecoin.htm?utm_source=openai))

5) Asia’s licensing and CBDC pilots

Hong Kong’s first license decisions will be a signal for Singapore and others in the region. If stablecoin issuers can meet bank‑like standards and connect to tokenized deposit pilots, expect trade finance and remittances to follow quickly. ([reuters.com](https://www.reuters.com/world/asia-pacific/hong-kong-passes-stablecoin-bill-one-step-closer-issuance-2025-05-21/?utm_source=openai))

Risks that still matter

- Concentration risk: A few issuers dominate supply. One bad disclosure or a sanctions episode can ripple across markets.

- Chain outages and bridges: Payments don’t tolerate downtime. If gateways fail, merchants and payroll providers will revert to cards and wires.

- Regulatory divergence: MiCA’s treatment of multi‑jurisdiction issuance and non‑EU currency tokens is still evolving. Cross‑border fungibility could face tests as supervisors coordinate. ([reuters.com](https://www.reuters.com/markets/europe/eu-commission-investigates-depth-eu-safety-net-stablecoin-holders-2025-01-23/?utm_source=openai))

The bottom line

Stablecoins aren’t replacing the dollar; they’re extending it. The GENIUS Act gives the U.S. a chance to codify how digital dollars should be issued and redeemed, which increases the odds that American standards become the default for global rails. Europe and Asia are responding with bank‑backed coins and licensing regimes of their own. For investors, the practical moves are simple: favor regulated issuers with transparent reserves; track who wins early licenses; and follow where large PSPs, merchants, and banks actually settle on‑chain. That’s where usage—and value—tend to concentrate.

Further reading: EBA summary of MiCA’s stablecoin scope.

also read:Future of WLFI Growth Driven by Whale Accumulation and Stablecoin Expansion

Trending

-

Gossips2 months ago

Gossips2 months agoKate Hudson Says ‘So Long’ to Summer with Bikini Pic Roundup and Photos of Son Ryder and Daughter Rani

-

Gossips2 months ago

Gossips2 months agoGeorge Clooney and Wife Amal Depart Venice Film Festival After Emotional Jay Kelly Premiere amid His Illness

-

Gossips2 months ago

Gossips2 months agoMan Documents Tattoo Removal After Divorce Led Him to Cover 95 Percent of His Body in Ink: ‘Felt Like a Circus Attraction’

-

Gossips2 months ago

Gossips2 months agoNaomi Osaka Calls Jelena Ostapenko’s Comments to Taylor Townsend ‘One of the Worst Things You Can Say to a Black Tennis Player’

-

NFL3 months ago

NFL3 months agoFans Can’t Stop Talking About This Glamorous Vacation Photo of Sean McVay and His Wife

-

Gossips2 months ago

Gossips2 months agoTravis Kelce Asked for Taylor Swift’s Dad Scott’s Permission to Propose — and This Is How He Responded, Says Ed Kelce

-

Gossips3 months ago

Gossips3 months agoThe Most Intelligent Dog Breeds in the World: The Results Might Surprise You!

-

Gossips2 months ago

Gossips2 months agoGeorge Clooney’s Film Jay Kelly Earns 10-Minute Ovation at Venice Amid His Illness, with Amal by His Side